"What exactly makes up those credit card fees I’m paying?"

It’s a question we at Qualpay get from businesses all the time. (If we had a dollar for every time we’ve been asked this, we’d be able to buy a small condo— but not in the Bay Area. Maybe Texas.)

Here’s the answer:

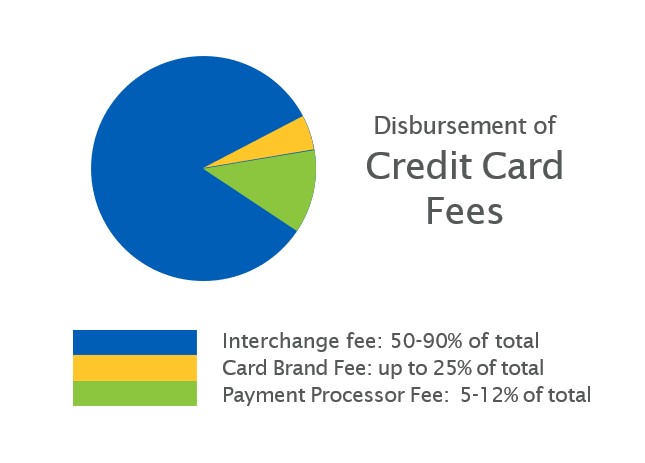

The fee a merchant pays to process a credit card has three elements. These three elements together make up the final single fee a merchant is charged for the ability to accept credit cards for payments.

Interchange fee

The first element is the interchange fee. This fee typically comprises the largest single cost of the final fee amount. It can be anywhere from 50 to 90 percent of the total.

The interchange fee is a grid of fees controlled by member banks of the card brands, like Visa and MasterCard, and is paid directly to them. This fee is determined by a matrix of card types, industries and acceptance criteria, yielding myriad possible combinations.

The interchange fee plus a flat fee is applied as a percentage of each credit or debit transaction.

Your payment processor should have the technology necessary to ensure each transaction qualifies for the lowest eligible interchange fee.

Card brand fee

The second element that impacts your total card acceptance expense is card brand fees and assessments charged by the card networks—Mastercard, Visa, American Express and Discover. These fees are a combination of per-transaction fees and fees assessed as a percentage of sales volume. This combination of fees can typically add up to 25 percent and more of your card acceptance expense.

The assessment fee pays for what the card brands do: facilitating credit card and debit transactions between the card issuer and the merchant, determining where credit and debit cards can be accepted and managing credit and debit card perks and rewards programs.

For all this, they assess a combination of fees based on the merchant’s transactions.

Payment processor fee

The third and final element that makes up the total a business pays when accepting credit cards relates to your payment processor. That would be what people like us here at Qualpay charge for facilitating card payments.

Like the interchange fee, the payment processor fee is a combination of transaction-based fees and fees as a percentage of the sale amount of each credit or debit transaction. A dizzying number of variables go into a business expense to accept credit card transactions.

Like the interchange fee, the payment processor fee is a combination of transaction-based fees and fees as a percentage of the sale amount of each credit or debit transaction. A dizzying number of variables go into a business expense to accept credit card transactions.Payment processors also charge for other features that affect their final fee amount. Some of these might be applied over time, like an annual service fee. Others might be monthly charges for equipment rentals. The size of a transaction and a merchant’s industry category can also contribute to the cost of the payment processor.

The payment processor fee can be anywhere from 5 percent to 25 percent of the final transaction fee. This wide variation has a lot to do with the many other products and services your processor provides to make your credit card transaction experience the best.

(At Qualpay, we provide a lot of great extra stuff—chargeback management, the best reporting in the business and unsurpassed customer service. And we do it at a very fair price.)

Got more questions about card fees? You owe it to yourself to get answers.

Analyzing your statements to understand your effective rate is one key to understanding how these three elements affect what you pay. So, if you still have questions about what makes up a credit card fee, don’t hesitate to contact those who know, like us.

Click here to learn more.

Latest from Waste Today

- New York finalizes greenhouse gas emissions reporting regulations

- EPA selects 2 governments in Pennsylvania to receive recycling, waste grants

- NWRA Florida Chapter announces 2025 Legislative Champion Awards

- Yolo County reports fatality at Central Landfill

- New Way expands Canadian presence with Joe Johnson Equipment partnership

- Buffalo Biodiesel shares updates on facility modernization, NYSDEC compliance

- CETY launches HTAP platform for anaerobic digestion facilities

- Terex Ecotec announces Blue Machinery as distributor