gui yong nian | stock.adobe.com

Professional ball teams know that dominating their league comes down to talent and youth. You can have great talent and win for one season … or maybe even two or three. But dynasties are built on youth. And to maintain that competitive edge, you must continue injecting talented youth into your organization.

The New York Yankees, the Dallas Cowboys, the Los Angeles Lakers. These teams got it; they had a tactical approach (talent) combined with a strategic approach (youth) that allowed them to dominate for many years. Equipment managers can learn a thing or two from these success stories.

Building a winning fleet

Those same rules apply to your organization’s equipment fleet. From a productivity and cost perspective, there is a sweet spot in a machine’s life. It’s that time when it’s still new enough to be strong and effective. The paint is worn but the muscle is there. It can do the job. It’s also old enough to have amortized those big capital costs and moved it into a favorable and relatively comfortable hourly rate.

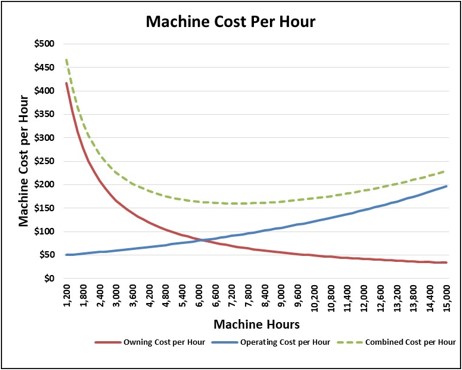

Here’s how that works. The hourly owning cost—think of it as the cost to purchase, finance and insure the machine—will decrease as you log hours on the machine. The more hours you use it, the lower the average owning cost.

But there are also operating costs, which tend to increase as the machine ages because of repairs, decreased productivity, reduced fuel efficiency, increased downtime and ever lower resale value. If we combine those costs (see chart 1) we can identify the financial sweet spot—that point where the machine has its lowest overall cost per hour. You can think of this as the machine being in its prime. Several factors like good maintenance and careful operation can extend this sweet spot, but no matter how careful you are, age eventually catches up to every machine.

Certain parts begin to lose their effectiveness, and the machine becomes less dependable. At this point, some older readers may be scratching their heads and wondering if I’m only talking about their machines. Well, yes … mostly.

The effects of age may show up first as a weak engine or less zip in the transmission. There are more squeaks and rattles. It will also be evident in terms of those pesky little things that keep an aging machine in the shop. Nothing major, mind you, just an increasingly steady stream of minor breakdowns that tend to pull a machine off the front line, requiring you to send in the backup team more than you used to … more than you like.

The key to managing your fleet is obvious. It must be managed—in terms of maintenance, repair, rebuild and replacement.

There are many factors to consider, but they are all filtered through the lens of machine age. Like racehorses and boxers, there comes a time when a machine simply isn’t up to the stress of daily competition. For your machines, this could mean a shift to backup position, a move to a smaller, less demanding facility or selling them. Do not hold on to old machines unless you have a specific purpose and timeline, such as waiting for a replacement machine or anticipating an increase in the scrap metal market. Machine boneyards serve no useful purpose.

Managing fleet age

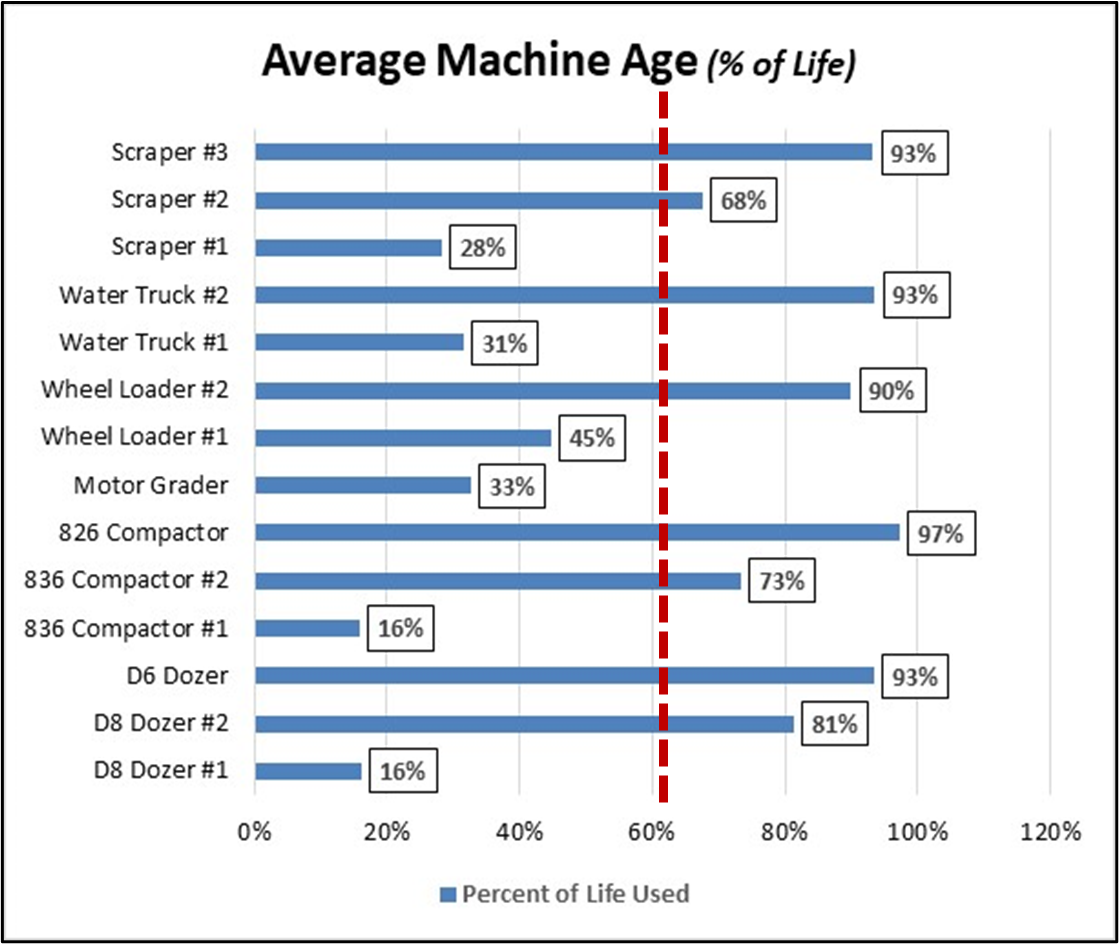

Look at the age of each machine compared to the total age of the fleet and see if your fleet is generally young—or old. In an ideal world, you should be keeping your fleet at its average age, with a healthy equipment replacement fund that makes it sustainable. That keeps your machines generally in the production/cost sweet spot, and ensures you aren’t spending money before you need to … or kicking that machine replacement can on down the road.

Waiting too long to build a machine replacement fund has caused a crisis for more than a few solid waste organizations. A good equipment replacement fund is uniform, consistent and predictable. When it comes to managing cash flow, nobody likes surprises.

This example (see chart 2) shows the age of each machine. The age was calculated based on the actual hours (or miles) divided by the estimated total life of each machine. This machine fleet is, on average, at 61 percent of its useful life.

It’s good to track the average age of your fleet, but the other thing you should consider is the actual timeline of when machines will reach the end of their life, because that’s what drives cash flow.

Neal Bolton is president and lead engineer for Blue Ridge Services – Montana Inc., a Hamilton, Montana-based solid waste consulting company. He can be reached at neal@blueridgeservices.com.

Latest from Waste Today

- ELV Select Equipment, Reworld aid NYPD in secure firearm disposal

- Waste Connections announces Q2 results

- Returnity and Cosmoprof to address reusable bag waste

- SWANA releases report on aging WTE facilities

- New economic assessment reveals cost benefits of California’s SB 54

- Premier Truck Sales & Rental opens new facility

- TeknTrash Robotics, Sharp Group partner on humanoid robot pilot

- Stadler equips mixed waste sorting plant in Sweden