Graphic courtesy of IDTechEx

In a move that would affect recycled materials commodity markets as well as the way hauling firms outfit their fleets, truck makers globally are expected to produce more electric vehicle (EV) commercial trucks at a compound annual growth rate (CAGR) of 37.1 percent during the next 10 years.

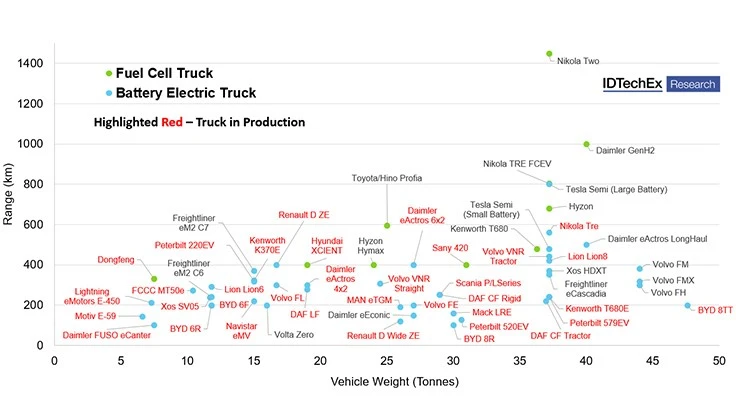

That estimate has been made by United Kingdom-based IDTechEx in a report titled “Electric and Fuel Cell Trucks 2023-2043.” The report’s researchers considered not only battery-powered EV trucks but also plug-in hybrids and those fueled by hydrogen or other methods considered “zero-emission” configurations.

IDTechEx says, “The vast majority of new trucks sold today are powered by diesel engines, but like other on-road vehicle segments, this is set to change. The scale of greenhouse gas (GHG) emissions reductions required to meet national targets effectively demands complete decarbonization of the truck market over the next 30 years. Major truck manufacturers and automotive suppliers now understand this; the fight for future market share is already underway.”

IDTechEx says its report “discusses the technical and economic aspects of zero-emission truck deployment, key enabling technologies, and presents IDTechEx’s granular 20-year outlook for the zero-emission truck market, with a focus on the key regions, Europe, the United States and China.”

The changeover thus far has been muted, notes the firm, with the global market share of zero-emission trucks in 2021 at only 0.4 percent of total sales, or about 13,000 units, with “the vast majority” of those in China, according to IDTechEx.

The research house says, “The limited sales penetration in Western markets reflects a lack of available zero-emission trucks rather than a lack of demand. Major corporations are clamoring for low-emission trucks (and greater support from governments) to help them meet their corporate pledges to reduce their GHG emissions.”

Most major vehicle OEMs have launched or are about to launch a zero-emission truck into regular production, says IDTechEx, which offers a timeline comparing the efforts of global truck makers (see graphic).

The added production capacity is why IDTechEx expects the global market to grow at that annual 37 percent pace during the next 10 years.

As fleet operators in the waste and recycling sector understand, IDTechEx says the key to zero-emission truck deployment involves their ability to “deliver useful range, because the weight and volume of today’s lithium-ion batteries limit the energy that can be stored on board [an EV] truck.”

IDTechEx says, though, that while “long-haul applications are not yet feasible, a large percentage of urban and regional routes are deliverable with battery electric trucks.” The U.S. Department of Transportation suggests about 50 percent of U.S. freight moves less than 100 miles per day. That, IDTechEx says, means “there is [a] significant share of truck operations that are ripe for electrification.”

On the hydrogen front, the research firm says a lack of hydrogen refueling infrastructure is a hindrance to that rollout. “However, several countries including Japan, Korea, Germany and China, are supporting initiatives to build hydrogen refueling stations,” adds the firm.

Information on how to access the full report, which contains more than 460 charts or slides, can be found here.

Latest from Waste Today

- IntelliShift honored at IoT Breakthrough Awards

- Glass Packaging Institute applauds regulation change

- Paper recycling is focus of 2 January webinars

- Disruption likely for material flows in mid-January

- Florida composting event takes place at worksites

- NC State research could improve predictions for solid waste management

- McNeilus unveils fully integrated, electric front-loading collection vehicle

- GFL Environmental Inc. to sell majority stake in Environmental Services business to Apollo, BC Partners